Designing Packaging to Prevent Unknown Loss and Shrink

How packaging design can reduce unknown loss / shrink

Table of Contents:

- Abstract

- - Packaging in Context

- - Complexities and Tensions in Packaging Design

- - Developing Integrated Packaging Solutions

- Understanding Unknown Loss / Shrinkage

- Understanding how packaging can create Shrinkage

- Delivering Change: Introducing the ECR Road Map Approach

- - Step 1: Develop a Project Plan

- - Step 2: Map Key Processes and Measure Problem

- - Step 3: Analyse Risk, Identify Causes and Prioritise Actions

- - Step 4: Develop Solutions and Prioritise Actions

- - Step 5: Implement Solutions

- - Step 6: Evaluate Implementation

- Minimising Packaging Related Shrinkage

- - Help Correctly Identify Products in the Supply Chain

- - Help Enable Product Protection

- - Shrink Prevention Packaging Guidelines

- Summary of Key Findings

Languages :

This report, which was published in 2010, provides guidance on how retailers and their suppliers can work together to identify and minimise the risk of shrinkage through the better design of product packaging. It is based upon a series of retail and manufacturer case studies in Europe, charting the impact of product design on the likelihood of increases in retail shrinkage.

The study recognises that the fundamental role of packaging is to deliver every product to the consumer in perfect condition at minimum cost and environmental impact. However, in order to achieve this goal, retailers and manufacturers often face competing challenges and tensions concerning the way in which products should be packaged, not least relating to the growing needs for sustainability, the differing and frequently competing demands of various parts of the supply chain as well as the need to apply product protection devices.

At the time of the study, it was estimated that shrinkage cost the industry globally as much as €174 billion, with a further €34.8 billion being spent on trying to respond to it. In addition, the knock-on effect on out of stocks and defensive merchandising was thought to be costing another €17 billion a year. Taken together, the report argues that if the average retailer could reduce their shrinkage by just 25% they could see their profits grow through reduced costs and increased sales by as much as 18%.

The research articulated the various ways in which packaging generates shrinkage, including: allowing contents to become damaged in transit; causing contamination through leakage; contributing to product loss through misidentification; losing their contents; becoming too unsightly to sell; suffering decreased shelf life and consequent reduced sales; and being more likely to be stolen.

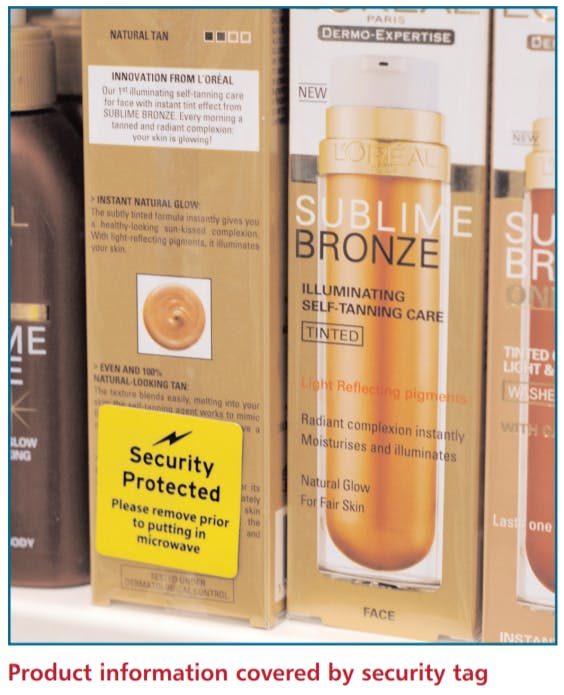

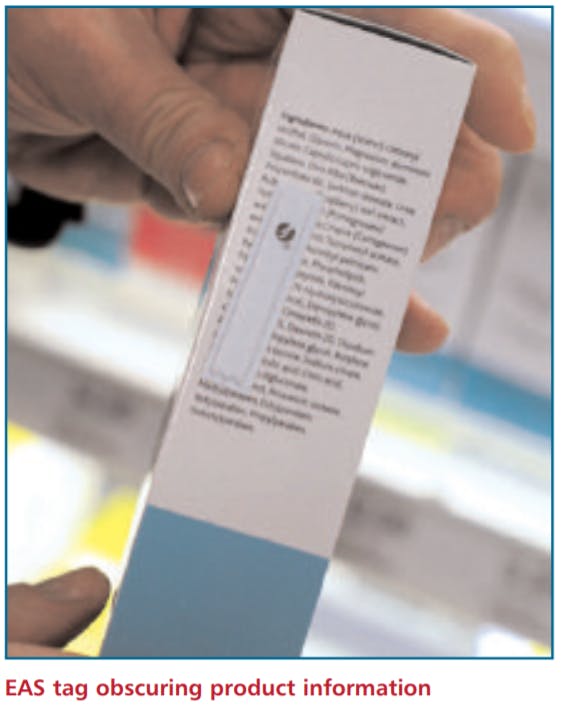

In addition, the research also notes that where products are subject to the use of additional security protection, they can suffer from: product information being obscured; stacking and presentational problems; annoyance and frustration to consumers; and damage to product packaging.

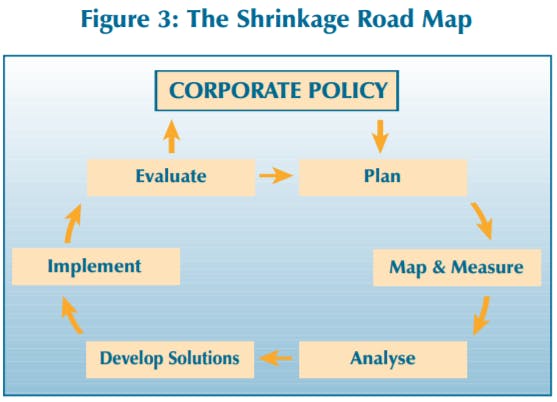

The report recommends the use of the ECR Shrinkage Road Map to identify the ways in which packaging generates shrinkage – a tried and tested method to systemically and systematically respond to the challenges of all forms of shrinkage.

Finally, the report offers a series of practical steps that can be taken to minimise the risk of packaging-related shrinkage focussing upon: improving product identification; reducing the risk of products being damaged; minimising the risk of theft; and improving the way security devices are used.

Abstract

This report, which was published in 2010, provides guidance on how retailers and their suppliers can work together to identify and minimise the risk of shrinkage through the better design of product packaging. It is based upon a series of retail and manufacturer case studies in Europe, charting the impact of product design on the likelihood of increases in retail shrinkage.

The study recognises that the fundamental role of packaging is to deliver every product to the consumer in perfect condition at minimum cost and environmental impact. However, in order to achieve this goal, retailers and manufacturers often face competing challenges and tensions concerning the way in which products should be packaged, not least relating to the growing needs for sustainability, the differing and frequently competing demands of various parts of the supply chain as well as the need to apply product protection devices.

At the time of the study, it was estimated that shrinkage cost the industry globally as much as €174 billion, with a further €34.8 billion being spent on trying to respond to it. In addition, the knock-on effect on out of stocks and defensive merchandising was thought to be costing another €17 billion a year. Taken together, the report argues that if the average retailer could reduce their shrinkage by just 25% they could see their profits grow through reduced costs and increased sales by as much as 18%.

The research articulated the various ways in which packaging generates shrinkage, including: allowing contents to become damaged in transit; causing contamination through leakage; contributing to product loss through misidentification; losing their contents; becoming too unsightly to sell; suffering decreased shelf life and consequent reduced sales; and being more likely to be stolen.

In addition, the research also notes that where products are subject to the use of additional security protection, they can suffer from: product information being obscured; stacking and presentational problems; annoyance and frustration to consumers; and damage to product packaging.

The report recommends the use of the ECR Shrinkage Road Map to identify the ways in which packaging generates shrinkage – a tried and tested method to systemically and systematically respond to the challenges of all forms of shrinkage.

Finally, the report offers a series of practical steps that can be taken to minimise the risk of packaging-related shrinkage focussing upon: improving product identification; reducing the risk of products being damaged; minimising the risk of theft; and improving the way security devices are used.

Introduction

The purpose of this report is to provide generalised guidance on how retailers and their suppliers can work together to identify and minimise the risk of shrinkage through the better design of product packaging. It seeks firstly to introduce the broader context of designing packaging and the challenges it represents before going on to offer a comprehensive review of the nature, scale and extent of shrinkage and the way in which packaging can and does act as a causal factor. It then goes on to provide a systemic and systematic methodology – the Shrinkage Road Map – which can be used to quickly and effectively identify packaging-related shrinkage problems, as well as design potential ameliorative actions. The final section of the report provides guidance on how the risk of packagingrelated shrinkage can be minimised, including a quick ‘checklist’ that can be used in conjunction with the Shrinkage Road Map.

Packaging in Context

The fundamental role of packaging is to deliver every product to the consumer in perfect condition at minimum cost and environmental impact. Poor basic packaging design significantly increases the risk of shrinkage. Badly designed packs are more likely to:

- Allow their contents to become damaged in transit.

- Cause contamination through leakage.

- Experience product spoilage or damage.

- Contribute to product loss through misidentification.

- Lose their contents.

- Become too unsightly to sell.

- Suffer decreased shelf life and consequent reduced sales.

- Be more likely to be stolen. In the specific cases where products are subject to the use of additional security protection, such as security stickers or Electronic Article Surveillance (EAS) tags they can suffer from:

- Product information being obscured.

- Stacking and presentational problems.

- Annoyance and frustration to consumers.

- Damage to the product packaging.

Complexities and Tensions in Packaging Design

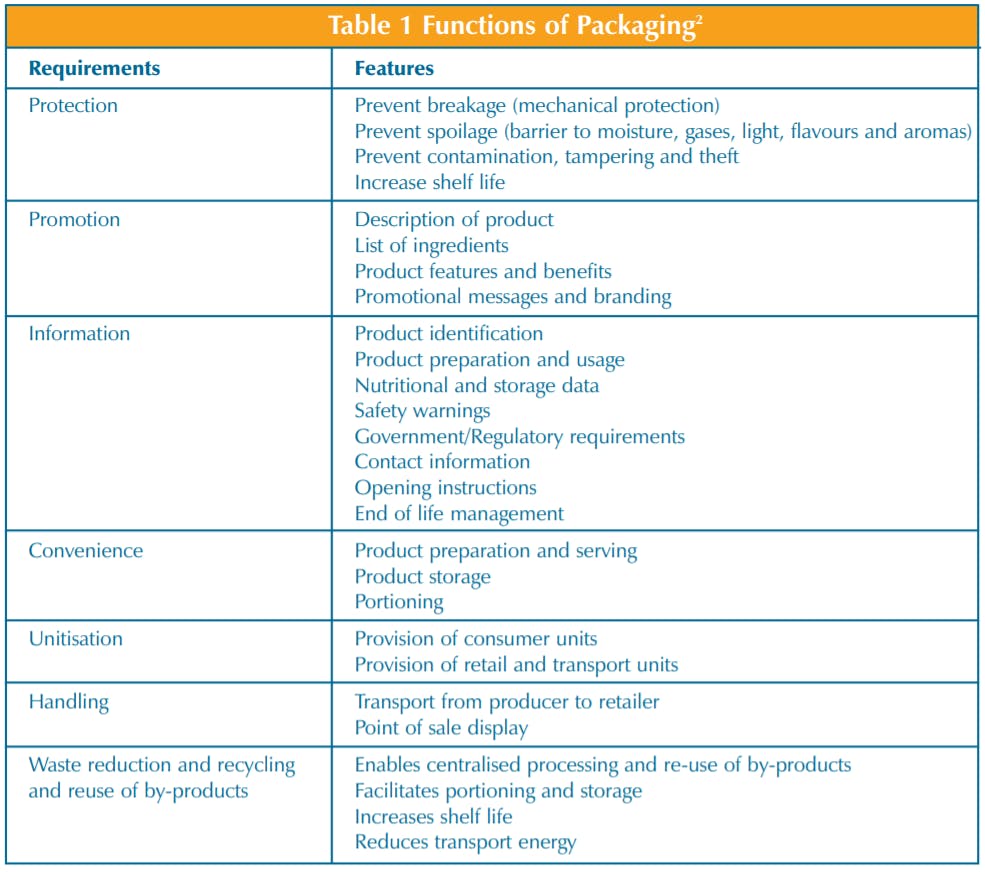

Designing packaging is a complex task and shrinkage protection has to fit within a matrix of often conflicting requirements which are summarised in Table 1 below.

As can been seen from the table below, good packaging, in its broadest context, needs to meet multiple requirements: it needs to ensure that the product reaches the consumer in pristine condition, is aesthetically pleasing, provides the consumer with clear product information, enables efficient handling throughout the supply chain, and minimises the risk of shrinkage. This can be extremely challenging, not least because in some circumstances each and any of these requirements can often compromise or undermine one or more of the other elements. For instance, optimising supply chain handling can undermine efforts to minimise the risk of shrinkage, and vice versa. Equally, satisfying the requirements of regulatory/ governmental bodies can have an affect, as can the post-production application of security devices to a product, such as Electronic Article Security (EAS). It is vitally important, therefore, to reflect upon some of these tensions and challenges as they relate specifically to effectively managing shrinkagerelated packaging issues.

Sustainability

Concerns about sustainability are frequently at the top of the agenda for consumer groups, environmentalists, governments, trade bodies, manufacturers and retailers. ‘Excessive’ packaging is frequently highlighted as a growing concern and for some groups ‘less’ is frequently associated with ‘better’ packaging. However, research by bodies such as the ECR/EUROPEN working group has recognised that it should be more about understanding how much packaging is necessary rather than simply minimising the amount of packaging used4 . If products cannot survive the rigours of the supply chain and end up being thrown away because they are too severely damaged to be sold to the consumer, then this has a greater effect on sustainability than adding slightly more packaging to secure the supply chain journey.

Similarly, having to remanufacture a product to replace one that has been stolen because the packaging has not provided sufficient protection from theft, is equally a false economy – the additional cost of more secure packaging frequently outweighs the cost of replacing the product5 . The sustainability debate needs to, therefore, understand the broader, more complex environment within which product packaging operates – sometimes, ‘more’ may be ‘better’ and this may need to be more effectively communicated to various groups, not least Government bodies who may not appreciate the complexities of this problem.

Benefits and Costs

Modern retailing is a highly compartmentalised industry with communication between and within businesses often being limited and frequently focussed only upon local needs and priorities – it can often be less about co-operation and more about conflict management.6 Developing packaging that meets conflicting demands requires genuine co-operation to ensure that local interests do not usurp the ultimate goal of getting the product to the consumer in saleable condition. In this respect, parts of the retail supply chain may need to absorb costs that do not necessarily directly address issues relating to their particular circumstances. For instance, increased manufacturer expenditure on better product identification on inner and outer case packaging may not directly help their part of the supply chain but could have a considerable positive improvement further down the process in retail warehouses and stores. In turn this could significantly reduce the problem of out of stocks and ultimately increase customer satisfaction.

The reality is that the outcome will most certainly benefit the manufacturer who is making the original additional expenditure, but it requires a degree of ‘joined up thinking’ and recognition of the ultimate diffusion of benefit from the changes made and the costs incurred – the costs are felt directly but the benefits may arrive more indirectly. This undoubtedly raises issues about whether these costs should be shared and who benefits the most – it is not the purpose of this report to resolve this issue but merely to identify that packaging-related shrinkage problems may be best addressed much further down the supply chain than where they occur and that the ultimate goal of satisfying the consumer should dominate the agenda.

Competing Demands

Tensions in packaging design are also apparent in innovations to improve the ‘ease’ with which customers can open products, such as the increasing use of perforated edges on some items. Similarly, the move toward greater shelf-ready packaging to improve the speed with which store replenishment takes place is another example of a tension between competing packaging demands7 . Both of these innovations can lead to a greater risk of products being damaged as they move through the supply chain and in some circumstances provide greater opportunities for employees to steal stock.

Equally, because retail supply chains are frequently long and complex with different handling requirements at different stages, this can create competing demands upon packaging. Information demands will and do vary depending on where the product is and who is handling it. For instance, while some consider more product visibility as a good thing (reducing confusion) others might consider this as less than ideal and likely to generate shrinkage – product theft by employees may increase in the supply chain if high value items are more easily recognised. Again, the solution is not easy, but undoubtedly resides in recognising the competing demands of packaging and how a development in one area may lead to problems arising elsewhere. By understanding the specific requirements of particular products moving through any given retail supply chain a suitable compromise may be achievable.

There are also tensions generated by some parts of the retail industry wanting to adopt globalised standards for their packaging (ultimately to reduce costs), for instance in the language used on packaging. As highlighted earlier, while this may have obvious benefits for one organisation, the knock on effect may be profound for other parts of the retail industry, such as causing localised consumer confusion leading to packs being more likely to be opened to examine contents and ultimately leading to shrinkage (such as damage).

Product Protection

Finally, there are numerous tensions generated by the desire by some retailers and manufacturers to apply security-related devices to products to reduce the risk of theft. Many of these are applied post manufacture and can cause a host of problems, including damage, product information being obscured, reducing the aesthetic appeal of the product and increased handling costs. The application of EAS tags is a good example of this problem and is compounded by a lack of a global standard relating to these products. The way they work, their size and application vary enormously depending upon the supplier, and this can cause major challenges to the retail sector and the way in which packaging is designed. As with some of the other tensions highlighted above, a better understanding of the impact of security devices on packaging requirements and improved dialogue between those determining what security will be applied to any given product and those tasked with the design of the packaging will help to reduce this problem.

Developing Integrated Packaging Solutions

What seems clear is that the demands upon packaging are many and varied and frequently come into conflict with each other – what is good for one part of the supply chain may not be good for another part. Equally, some of the costs of resolving these issues may have to be borne by both retailers and manufacturers. But ultimately, getting packaging ‘right’ is critical if the ultimate ‘boss’ – the consumer – is going to see the benefits. In this respect it is in the interests of all parts of the retail supply chain to collaborate to begin to resolve many of the packaging tensions highlighted above. Not all are easy to address and some may simply be the inevitable cost of irresolvable priorities. However, to date there has been insufficient crossfunctional thinking on this issue and there is undoubtedly much that can be done in the future. Packaging-related shrinkage has to date been an underexplored area, mainly because the scale, nature and extent of the problem has not been well understood. It is to this subject that the next part of this report moves – understanding the enormous financial cost of shrinkage and the significant profit improvement opportunities available to those organisations that begin to address this issue.

Understanding Unknown Loss / Shrinkage

In order to comprehend the inter-relationship between shrinkage and packaging it is important to first of all briefly review the overall context: what we understand the term ‘shrinkage’ to mean, what is known about its scale and extent, how problems with packaging can generate shrinkage, and the overall affect shrinkage can have upon the shopper experience and retail profitability. We think this section is important for those who are relatively unfamiliar with the nature and extent of shrinkage in the retail sector and for those who have traditionally viewed shrinkage as a problem exclusively focused primarily on external theft issues.

Defining the Problem

Consensus is hard to find on what the term ‘shrinkage’8 means and what should be included and excluded when this word is used within a retail context. For example, some use it to refer only to those losses that are unknown in the business, while others suggest it should be focussed exclusively upon losses generated by theft. How it is defined within any business, but especially those that sell food, can have a profound impact upon how much it is perceived to cost (such as including or excluding the costs of wastage and product mark downs). It can also significantly affect the scope and responsibilities of differing parts of a retail organisation, with the function of loss prevention expanding and contracting in direct relation to the narrowness or breadth of the way in which shrinkage is defined. Indeed, this lack of an agreed definition has made benchmarking within the industry all but impossible with retail companies across the globe adopting a myriad of different interpretations, which in turn make any meaningful comparisons highly problematic.

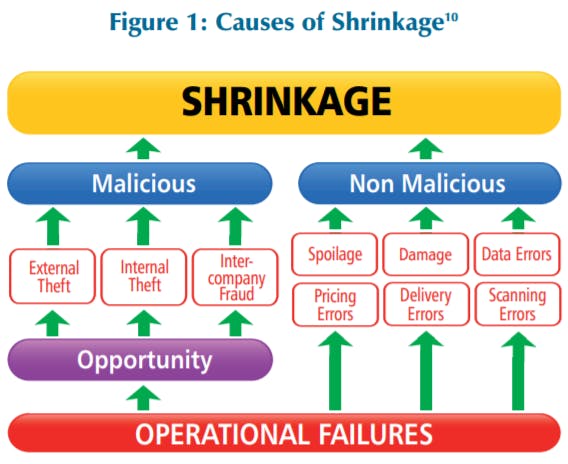

Within the ECR Europe community efforts have been made to try and establish some consensus on how shrinkage should be viewed including what the term ‘shrinkage’ means. They have developed a working definition that suggests that shrinkage should be viewed as: ‘intended sales income that was not and cannot be realised’9 . This is a purposefully broad definition intended to incorporate as wide a spectrum of losses as possible to ensure that all the possible causes of shrinkage are considered. Moreover, the ECR Europe Shrinkage Group now endorse the model outlined below, which views operational failures as the root cause of most forms of shrinkage.

This model views shrinkage as made up of malicious and non-malicious forms of shrinkage. Malicious events represent those activities that are carried out to purposefully steal goods, services and ultimately profit from an organisation. Nonmalicious events occur within and between organisations that unintentionally cause loss, through poor processes, mistakes, bad design and so on. The importance of understanding the intentionality of a shrinkage occurrence is the impact it has upon the approach taken to tackle it and the expected longevity of the results of an intervention. For example, malicious losses are intentional and occur deliberately, usually with a degree of forethought, such as incidents of customer theft from the retail store where thieves will constantly seek ways to circumvent current approaches designed to protect the product. In contrast, unintentional or non-malicious shrinkage such as products being damaged in the supply chain because of poor quality packaging, is not planned and hence solutions are more likely to last longer as they are not subjected to the attention of criminal creativity. While solutions to the latter may require similar levels of vigilance (for instance to make sure staff are continuing to follow procedures) they are less likely to be anything like as vulnerable to redundancy.

Malicious Shrinkage

This type of loss is traditionally viewed as being made up of three factors: internal and external theft and inter-company fraud.

Internal theft: the loss of goods through incidents where the theft of products takes place by somebody directly employed by the business (including those carried out by staff contracted with another company but who are working almost exclusively for the host business, such as contract guards or cleaners), including incidents where they have colluded with outsiders to enable them to steal. This includes the direct removal of products from the store, eating stock while at work (which is termed grazing) or using other products while at work for personal gratification, such as health and beauty items.

External Theft: the unauthorised taking of goods from a store at any time of the day or night by customers or other non-company employees. This includes: incidents of goods being stolen while the store is open (commonly called shoplifting), such as the direct removal of products from the store, eating stock while in the store (grazing) or the use of products in the store, such as administering pregnancy tests in the retailers’ toilets; the fraudulent return of goods (such as removing an item from the shelf and then taking it to the returns desk and demanding a refund) and burglary (breaking and entering a store whilst it is closed) and stealing stock.

Inter-company Fraud: seen as losses due to suppliers or their agents deliberately delivering less goods than retailers are eventually charged for by them or delivering products of a lower quality than originally agreed. It also includes those losses suffered by the supplier when retailers themselves decide to deliberately return fewer goods to manufacturers/suppliers than agreed/specified.

Non Malicious Shrinkage

This type of shrinkage is made up of a myriad of factors that are often described as process failures or administrative losses and include the following (and other) factors:

Damage: goods that have been damaged during the process of delivery, storage and merchandising of the goods which means they cannot be sold for any value. Examples would include: a pallet of sugar that is left outside in bad weather; cartons of washing powder crushed by a forklift truck; pears/bananas that have been badly bruised; or bottles of wine that have been smashed.

Wastage/Spoilage: products that have reached their expiry date or gone beyond agreed temperature parameters and are no longer safe to sell to consumers or staff. Examples would include: fresh meat and vegetables, fish, ready-made meals, frozen foods, dairy produce, bread, flowers and so on.

Pricing: losses caused by errors in the way in which goods are priced and sold in the business. Examples would include: head office setting up a promotion incorrectly but advertising it nationally meaning the stores have to discount locally; goods coded incorrectly on the store inventory system; staff incorrectly pricing product in the back room areas or on the shelf; a mismatch between agreed and actual selling price; or a member of staff entering the wrong price at the till.

At the checkout: errors occurring at the point of sale that lead to a positive or negative discrepancy in the store book stock. Examples would include: a till operator entering the wrong code for a product; entering a single code for multiple varieties of a product such as tinned pet food; not scanning free products as part of a promotion such as buy one get one free offers; a till operator forgetting to scan goods such as items at the bottom of a trolley or those removed from keepers/safer cases; or a till operator using a ‘dump’ code to sell items that are not easily scanned/identified.

Delivery Errors: errors generated by the movement of goods within the business. Key areas of vulnerability would include mistakes made in the receiving of goods, the transfer of goods and returns/refunds. Examples would include: shortages in deliveries to a store directly from a manufacturer or a distribution centre; transfers to others stores incorrectly recorded; products for use within the store not recorded properly; goods returned to the store by the consumer that are not entered back onto the system, or cannot be returned to the supplier.

Data errors: errors in the recording of stock on company systems. Examples would include: retail buyers/suppliers incorrectly inputting item set up details that lead to stores receiving less items than identified on the system; items that are not correctly associated with the book stock database, such as promotional items not linked with items in the main assortment; and products registered on the store inventory that have not been delivered.

Role of Opportunity and Operational Failures

While the various forms of shrinkage defined under malicious and non-malicious shrinkage offer a relatively comprehensive overview of the various types of loss that can be used to categorise shrinkage, they do not offer a way of understanding what the root causes of these problems are – they are descriptive but not explanatory. This model suggests that the root cause of the majority of losses is due to operational failures within a retail business. The ECR Shrinkage Group adopts a relatively broad definition that sees operational failures as any fault in the design, implementation, operation, monitoring and control, and review of processes and procedures used within the retail environment. Operational failures can occur at any point in the supply chain from point of manufacture through to the eventual sale of goods to the customer (and beyond in respect of product returns). In the context of this report, the way in which packaging can generate shrinkage would be viewed as an operational failure (the design of the packaging is the root cause of why the shrinkage happens).

Scale and Extent of the Problem

Because of the tremendous variance in the way in which different organisations define shrinkage, it is less than easy to get an accurate overview of the scale and extent of the problem. Numerous surveys have been undertaken over the past 20 years or so trying to gather information from retailers on the way in which they are affected by shrinkage. The most recent effort to do this was the Global Retail Theft Barometer undertaken by the Centre for Retail Research in the UK in 2009. This concluded that shrinkage in the 41 countries taking part accounted for 1.4 per cent of retail sales amounting to €86 billion11 . Another study has concluded that globally shrinkage could amount to as much as €208 billion (including €34.8 billion spent on responding to the problem)12.

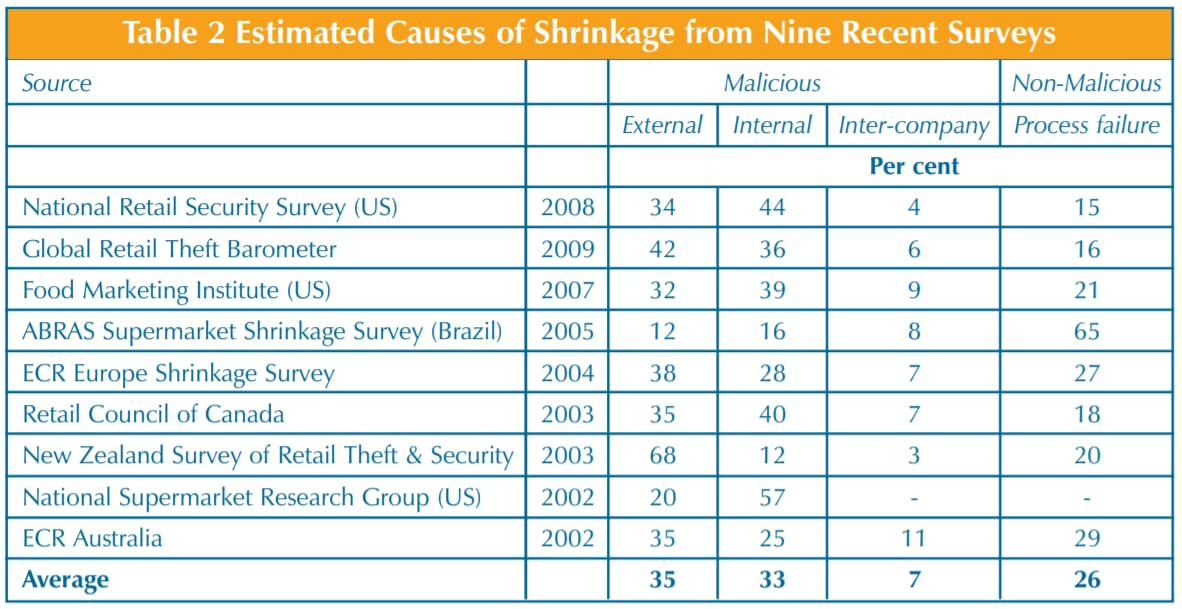

All of the surveys on shrinkage generally offer estimates of the extent to which the different types of shrinkage (external theft, internal theft, intercompany fraud and process failures) account for loss. Detailed in Table 2 below is a composite list of the most recent surveys and the proportion of loss assigned to the four types of shrinkage.

Making sense of the considerable fluctuations in this data is not easy although the underlying problem that these are only ever ‘guesstimates’ by respondents probably explains why there is very little consensus across the various surveys.

However, if a crude overall average is taken then it can be seen that internal and external theft are each seen to be responsible for about one-third of all losses, while process failures account for a further one-quarter, with the remaining 7 per cent being seen as the responsibility of inter-company fraud. However, it needs to be remembered that ultimately these estimates tell us more about how retailers are thinking about the problem than it does the actual extent to which different types of shrinkage are responsible for loss.

Impact of Shrinkage on the Shopper and Retail Profitability

Impact on Shopper

As indicated earlier, the direct cost of shrinkage to retailing is considerable, but there are also additional consequential costs that are not accounted for in the estimates presented above. These include the impact of shrinkage on the shopper, which can take the form of out of stocks and/or defensive merchandising strategies.

Out of Stocks: Shrinkage corrupts inventory records meaning that the book stock levels shown on the system will be inaccurate. The system will accordingly either not replenish those items where the book stock is overstated or place additional orders where the stock is understated. Either way, the shopper may not find the product that they want on the shelf and the retailer and the manufacturer may lose that sale.

Defensive Merchandising: Much accountability for managing shrinkage on a day-to-day basis often lies solely with store managers who are frequently incentivised to deliver low shrinkage and are given significant autonomy in adopting localised solutions to achieve this goal. For high risk products, especially health & beauty, where there is a perception that the cause is usually external theft, store managers may remove the products from self selection, placing them either in locked glass cabinets or behind the customer service desk or pharmacy counter. This can have a detrimental effect on sales as customers are much more likely not to purchase goods that are not on open display13.

While accurate estimates of the financial cost of out of stocks caused by shrinkage and defensive merchandising are not available, a study by Corsten and Gruen estimated that out of stocks could be causing retailers to lose the equivalent of 3.9% of annual sales14. Globally this could be worth $586 billion a year. Estimates by Beck and Peacock have suggested that globally shrinkage-caused out of stocks could be worth as much as $92 billion a year15.

Impact on Retailer Profitability

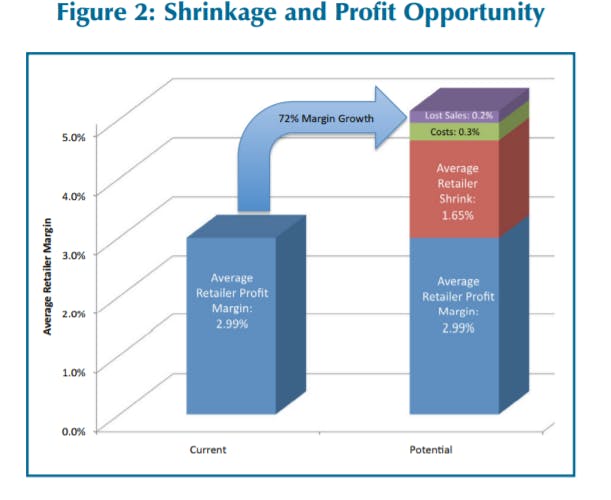

Traditionally, shrinkage has been measured as total losses as a percentage of retail turnover, focusing on the absolute cost to the business. However, recent thinking has begun to represent shrinkage more as a significant opportunity for increased profitability. For example, an estimate of the average retail profitability within the European Fast Moving Consumer Goods sector concluded it was 3 per cent16. If the recent global estimate of the cost of actual shrinkage suggested by Beck and Peacock of 1.65 per cent of sales is used, and this is combined with their estimate of the average amount spent on managing shrinkage (0.3%) and the estimated lost profit from sales caused by shrinkage-induced out of stocks (0.2%), then the elimination of all shrinkage would grow average sales by as much as 72 per cent17. Even if a more realistic target of reducing the overall cost of shrinkage by just 25 per cent is used, this would still provide most retailers with a sales growth opportunity of about 18 per cent – a considerable uplift in profitability

Understanding how packaging can create Shrinkage

As detailed earlier, the root cause of most forms of shrinkage is operational failures and packaging has a direct role in generating these failures. Detailed below are some of the main ways in which packaging can generate shrinkage, organised around four key areas: Damage; Error; Waste; and Theft. It is also important to reflect upon the way in which packaging design can compromise efforts to try and protect products from shrinkage, in particular, but not exclusively relating to the application of Electronic Article Surveillance (EAS) tags.

Damage

Products that are damaged in some way as they move through the supply chain are a perennial source of shrinkage for retailers. Depending upon the level of damage and type of product involved, it can lead to stock having to be returned to the manufacturer, sold at a lower price than originally envisaged or simply written off by the retailer. In any event, products that become damaged are undoubtedly a major source of loss for the retail sector and can also contribute to out of stocks – the damaged item will still be considered ‘in stock’ by automated ordering systems until the inventory record is manually adjusted.

Products can become damaged for a number of reasons, only some of which may necessarily be reduced or eliminated through better packaging.

But, it is important to understand the operating landscape within which products will be moving – it is no use creating packaging which simply cannot adequately survive the environment within which it will reside. Indeed, the degree of protection afforded by packaging may need to change as the environment changes – for instance as the product gets closer to the shelf, then it is far more likely to receive less robust handling techniques (although customer handling at the shelf may be relatively robust!).

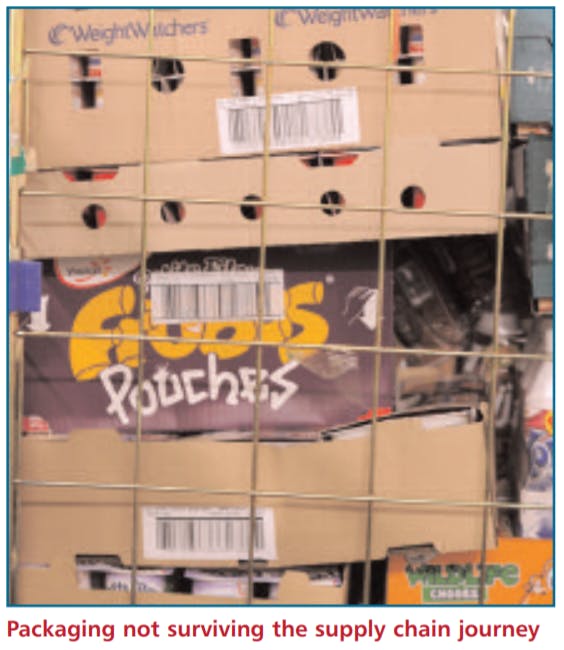

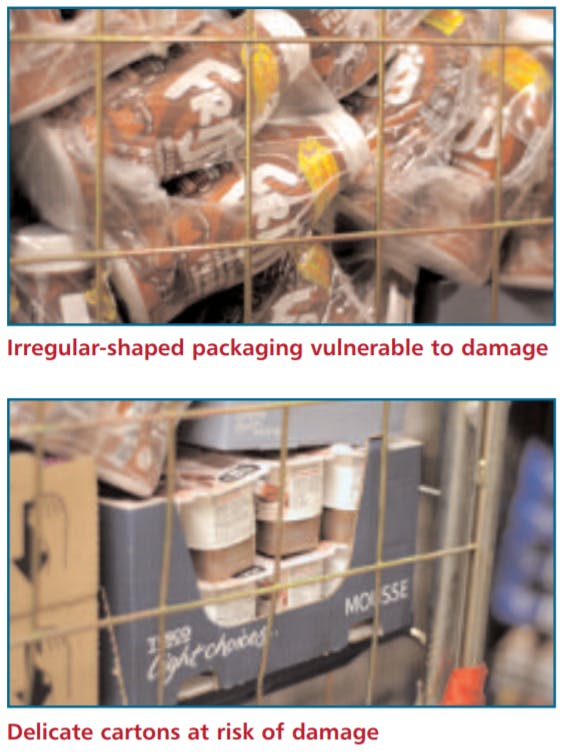

For example, products that are moved on pallets or in cages will experience higher degrees of robust handling than those which are being moved by hand, say from the back of the store to the shelf. Therefore, the range of packaging used for products (outer, inner and around the product itself) needs to be designed for the environment within which it will operate and be prepared for the degree of robustness that it is likely to encounter. For instance, the three examples below show how products being transported in a cage are experiencing damage because of the nature of the packaging and the environment within which it is moving – the first shows how stacking is causing damage, the second how irregular product shape is causing problems, while the third highlights how relatively delicate and unprotected cartons can be damaged.

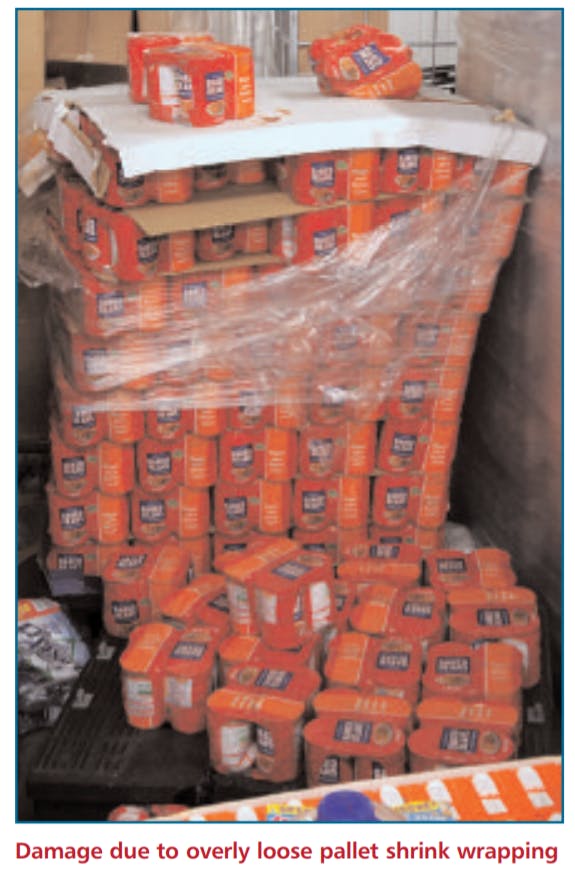

Products can also be damaged by the way in which pallet shrink wrapping is utilised to facilitate the transportation process – too severe and it leads to crushing, too slack and it can lead to products spillage and consequent damage. Below are two examples of this problem:

While some will argue that these issues go beyond that of packaging and enter the realm of staff (in)competence and procedural compliance, the reality is that such instances are likely to occur within the retail environment and therefore need to be considered as a packaging-related issue which could be resolved through more thoughtful design (such as outer pack resilience).

Packaging designed to help the customer more easily open the product, such as the use of perforated edges, (see the example below) can compromise the integrity of packaging prior to reaching its final destination and lead to it becoming damaged and unsellable.

Similarly, shelf-ready packaging can also contribute to products becoming damaged as they move through the supply chain due to the way in which it has been designed to facilitate quick and easy display on retail shelving. As detailed earlier, this is a good example of one of the inherent tensions in product packaging design – changes to benefit one part of the retail operation can have negative consequences for another part of the business.

Both of these examples highlight the delicate balance that needs to be struck between the desire for packaging that delivers convenience, efficiency and reduced employee handling time with a need to ensure it is sufficiently protected as it moves through the entire supply chain – too much or too little of one can in some instances can severely compromise the other. As will be discussed later, by using the ECR Road Map, achieving this balance is possible through careful analysis and observation of the processes products move through in the retail supply chain.

Products can also generate shrinkage through damage in the way in which they are stacked. The example below graphically shows how a product has not survived well the supply chain journey because of the way in which other products have been stacked on top of it. Again, this highlights the importance of understanding the nature of the landscape through which the product will journey and the extent to which the packaging can endure the associated robustness of handling. In this case, irregular stacking (a not uncommon phenomena within retail supply chains!) has led to the crushing and buckling of a box of wine which, given the nature of the product will probably not now be saleable.

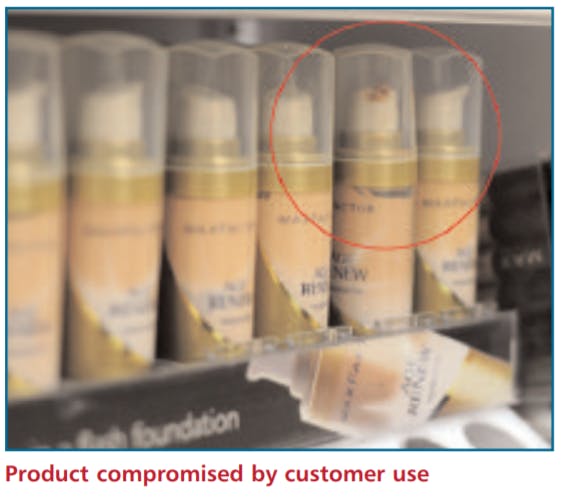

Finally, products can be damaged when customers want to ‘test’ the product prior to purchase. This is particularly the case for health and beauty products such as skin care and cosmetics. The examples below show how the lack of available testers means that products are opened and partially used leading to them to becoming essentially damaged and unlikely to be sold. This highlights the need for accessible and useable tester display products and the need to secure such products through better packaging to reduce the likelihood that they can be opened in the event of a tester not being available.

Error

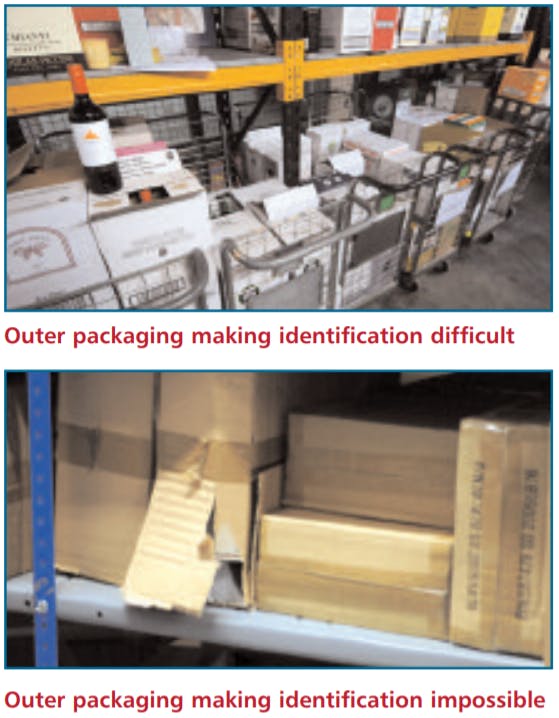

The second area of where packaging can produce shrinkage is through the generation of errors in the retail process relating to the identification of products, the incorrect registration of products on inventory systems and when products are eventually sold to the consumer. This problem manifests itself in at least three ways. First, insufficient or unclear product descriptions on outer packaging can make the task of product pickers in the distribution system more error prone. For instance, employees tasked with selecting products in the warehouse prior to distribution to retail stores frequently work under considerable time pressures (such as a requirement to pick a certain number of products per hour in order to achieve certain levels of pay) – they need to be able to quickly identify the products they are required to select. They also need to know how a required quantity relates to the volume of items in a given inner or outer – does an order of ‘one’ mean one outer, one inner or one item?

The two examples below show how outer packaging has made it difficult (if not impossible) to identity what is contained in the outer boxes. This can then lead to products not being picked at all (the picker simply moves on to easier to identify products) or the wrong products being picked, both of which can lead to a subsequent out of stock situation on the shelf.

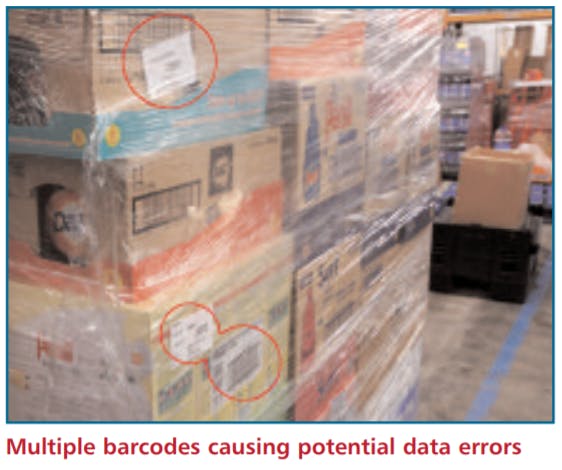

Secondly, the use of multiple barcodes on outer packaging can cause error when goods are being checked into a retail store. The example below shows a delivery cage that has several bar codes that could easily lead to confusion on the part of the goods receiving team. If a retailer uses these barcodes to ‘book’ stock onto their store inventory then depending upon which barcode is scanned, this could lead to the wrong amount of stock being allocated. Shrinkage could then be generated by unallocated stock either being stolen (staff realising that it is not on the system and hence perceiving it is easier to steal) or lead to further stock being ordered which in turn could lead to an increased chance of damage as the backroom area becomes overstocked.

Multiple bar codes on products can also lead to problems at the till. This is particularly the case with multi packs where there may be a barcode on each product as well as on the packaging for the set of items. Depending upon which barcode is scanned by the till operator (or in the case of self scan checkouts, the customer) the eventual price charged could be considerably lower than the actual price. This can cause considerable amounts of shrinkage as customers are effectively being given free products simply because of the confusion caused by multiple barcodes on different parts of the packaging.

Barcodes that are poorly located on products or are difficult to read by scanners can also cause significant problems, sometimes leading to checkout employees using generic ‘dump codes’ to speed up the scanning process. The use of these codes can severely compromise the inventory records of stores, particularly where automated replenishment systems are used. The sale of the item is not recognised by the system (it has simply been scanned through using a generic code) and therefore is unlikley to be replenished and out of stocks and data inaccuracy with follow.

Waste

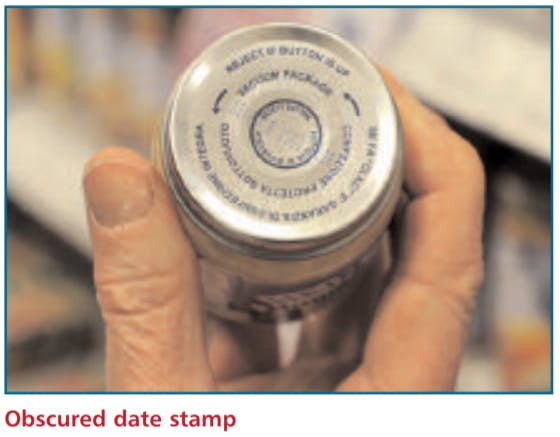

For retailers that sell date sensitive products such as supermarkets, being able to quickly and easily identify the sell-by-date of products is critical if they are to minimise shrinkage losses through waste. As items begin to reach their sell-by-date retailers need to be able to easily identify them and discount accordingly to encourage a sale. If they do not, then products which go beyond their agreed sell-by-date have to simply be discarded, generating significant shrinkage in the process. In this example, the date stamp has been overprinted on other information making it very difficult to identify

Theft

The final area of shrinkage that packaging can have an affect upon is theft when it is on open display in the store. This can manifest itself in many ways, but the key areas can be summarised as size of packaging and product accessibility. Many products sold by retailers are relatively small, particularly in health and beauty. For example, creams and certain types of cosmetics can have a relatively small shelf footprint in relation to their retail value. As detailed at the start of this report, there are ongoing tensions between sustainability (using a sufficient amount and type of packaging that is perceived as reasonable given the size of the product) and risk (making it sufficiently difficult to easily conceal the product by would-be thieves). The examples below highlight this tension.

Work by criminologists has highlighted the importance of concealability when offenders decide which products to steal from retail stores and therefore the way in which packaging or the lack of packaging impacts upon the overall footprint of a product can be one of the key explanatory factors in understanding why some products are more prone to theft than others18 .

A second theft-related factor is the extent to which products can be stolen by removing them from their packaging while the thief is still in the retail store. Certainly for the opportunistic offender (as opposed to those who are seeking to sell on the goods they steal) then it is the product itself they are interested in and not its associated packaging. The example below shows how easily accessible packaging can enable a thief to simply and easily remove the product leaving the packaging behind.

Difficulties Applying Product Protection

In addition to the factors outlined above, packaging can also cause a number of problems when it comes to the application of product protection devices, particularly relating to the use of EAS tags and security stickers. Outlined below are some of the key problems associated with packaging and the application of security products.

Particularly for more opportunistic thieves, the degree of visibility of the protection device is an important factor in creating deterrence – the more visible the security the less likely thieves are to steal the product (essentially increasing their perceived risk of being caught). A common approach adopted by some retailers is the application of security stickers warning potential thieves that the product is protected by some form of electronic tag (which may not necessarily be the case). Depending on the size and location of this sticker, it can seriously compromise the overall look of the product as well as obscure important product information, which could mislead the consumer and be potentially illegal in some markets. Below is an example of this situation.

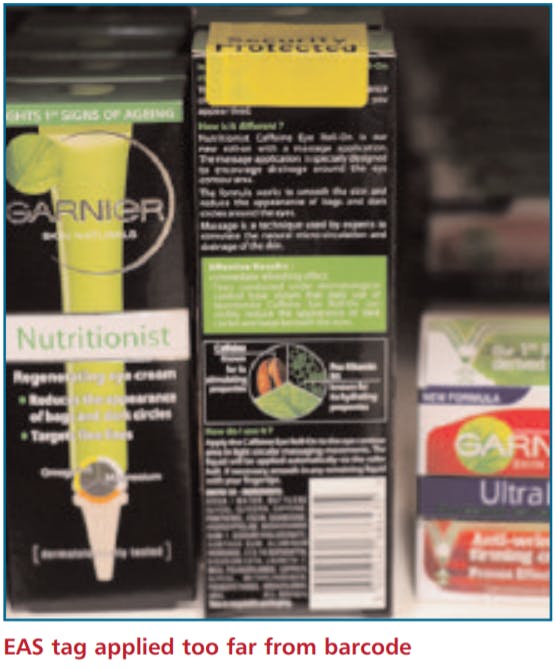

Similarly, many retailers will apply a ‘soft’ EAS tag to the product that if not deactivated at the till will cause an alarm to be activated at the exit of the store. These tags are widely used in the retail sector across the globe but, like the security stickers mentioned above, can, depending on where they are positioned, compromise the overall look of the product, obscure product information, make the tag ineffective and cause problems with deactivation at the till. Below are some examples of these problems.

In the first example, the soft tag is obscuring much of the product information making it difficult for the consumer to read it.

The second example is similar but also highlights how the size of the packaging (small) can lead to the tag itself being compromised (the tag is bent around the corner of the packaging which is likely to make it malfunction).

The third example shows how if a tag is located some distance away from the barcode, then when a member of staff scans the barcode the EAS tag is unlikely to be deactivated at the same time which can lead to a false alarm activation at the exit of the store.

Retailers also make use of ‘hard’ EAS tags which are considered to be a much more robust and visible form of deterrent on theft prone products. However, unlike ‘soft’ EAS tags that are simply stuck onto products with an adhesive, ‘hard’ tags require a pin to be anchored through the product packaging (they are frequently used on garments where the pin can be easily pushed through fabric or through the product label). Increasingly these tags are being used to protect a wide range of products but their design requires that the tag must not be easily removeable by a potential thief. Below are some examples of how product packaging can cause problems with these devices and also how the tags themselves can compromise the product packaging.

The first example illustrates how the application of a hard tag on a premium bottle of champagne has severely compromised the display of the product and potentially impacted upon the likelihood of this product being sold (not least because the aesthetics of the display box which is an important part of the marketing of this product has been devalued).

The second example shows how a hard tag has been rendered largely ineffective because the pin application is through a hole that is too large and hence means that the tag can be far too easily removed.

The third example shows how a hard tag has been successfully secured to robust packaging but in the process has made the display of the products on the shelf unsightly.

The fourth example shows how the application of the hard tag through the middle of the packaging (to make it difficult to remove) is covering up important customer information (similar to the soft tag example above).

The example below is similar – tag obscuring product information – but also the packaging is relatively weak (made only of cardboard) and so the tag could be easily ripped off if it is near the edge.

Finally, the use of ‘spider’ EAS tags can also compromise the quality of the packaging of products. These devices are generally used to secure high value relatively bulky items that are easily opened and their contents stolen. In order to ensure their effective use, the spider tag needs to be very securely attached to the product that can cause problems to packaging that cannot withstand this robust approach to the application of such devices. In addition, and like the other two types of EAS tag highlighted above, spider tags can also obscure product information reducing the customer’s opportunity to learn more about the product they are interested in purchasing.

The examples below highlights these particular problems.

Shrinkage and Packaging

As can be seen, the scale and extent of the problem of shrinkage is considerable and yet it is also an enormous opportunity for those retailers that recognise the way in which effective shrinkage management and control can increase retail profitability. What is also apparent is that the majority of shrinkage losses are caused by operational failures within the retail sector. What the various examples above show is that packaging can play a profound role in generating the operational failures that ultimately cause shrinkage. The next part of this report will outline an approach developed by the ECR Europe Shrinkage Group to enable organisations to quickly and easily identify the particular operational failures that are being generated by product packaging – the ECR Shrinkage Road Map.

Delivering Change: Introducing the ECR Road Map Approach

Given our overarching premise that operational failures are the root cause of most forms of shrinkage, the next step is to describe an approach, which has been developed over a number of years by the ECR Europe Shrinkage Group for identifying these failures. This work, which began back in 1999 sprung from the Group’s desire to develop a new way to begin to address the challenges of shrinkage within the retail sector. In the subsequent years, the Group has road tested this approach in over 40 companies and across more than 100 supply chains. It is thought to have produced savings in excess of €600 million for those companies that have used it. The approach is called the Shrinkage Road Map, and it is made up of a series of steps that enable loss prevention practitioners to more accurately identify the root causes of the problems they face and then develop ‘fit for purpose’ solutions to deal with these problems. In the context of this report, we believe it is a valuable tool for identifying how problems with packaging can lead to shrinkage. Underpinning this ‘Road Map’ are five key principles:

- Adopt a systemic approach to identifying and analysing packaging problems from a supply chain perspective. Supply chains consist of a large number of diverse activities, each concerned with different aspects of the handling of products and exchange of information. These various activities combine to form a series of processes and procedures (and potential areas for operational failures to occur).

- Adopt a systematic approach to understanding the problems of packaging. Supply chains are inherently complex and therefore to understand the vulnerabilities they present any investigation needs to break down the overall activity into a series of manageable component parts, which can be done through an analysis of existing processes.

- Develop an approach which is focussed on identifying the key areas of risk within the business, something which has been described as the ‘hot concept’. This seeks to identify the ‘hot’ products, places, processes and people within retail organisations and making them the focus of initial ameliorative actions.

- Collect accurate and timely shrinkage data. The Shrinkage Road Map encourages the collection and analysis of as much data as possible relating to the shrinkage problem under consideration prior to any decision-making relating to possible solutions.

- Develop a collaborative approach. Much of the success achieved with the Shrinkage Road Map has been through the bringing together of all parties who have some responsibility for the movement of goods through their entire life cycle (from the moment of manufacture right through to the time when the customer leaves the store with the product) and therefore can have an impact not only upon the propensity for packing-related shrinkage to occur but also how it might be alleviated.

The Shrinkage Road Map

The Shrinkage Road Map is intended to act as a manual or guide, describing the overall activities that need to be undertaken in order to reduce packaging-related shrinkage through the identification of the root causes of specific problems. This guide consists of a general approach made up of the steps a company needs to follow, together with techniques and tools to help undertake each phase and to deal with packaging problems that may be encountered. The general approach that forms the heart of the guide is shown in Figure 3. As can be seen, this structure is both simple and systematic and provides the means for planning and undertaking projects while guiding users towards continuous improvement through the cycle.

The Shrinkage Road Map is designed to enable both problem diagnosis and solution implementation. The structure consists of a sequence of steps where through well-planned investigations, the packaging-related failures that can present opportunities for malicious and nonmalicious loss are exposed. These vulnerabilities are then prioritised and subsequently analysed to reveal the underlying root causes. The multidisciplinary project team can then work together to develop appropriate solutions. These solutions are, where appropriate, tested in trials where their effectiveness is assessed. Where a solution is found to be successful it is then implemented widely and business practices standardised around it.

Step 1: Develop a Project Plan

The first step in the Shrinkage Road Map is planning. Planning is based upon setting clear, realistic, attainable objectives with criteria for knowing when these objectives are met. This requires the shrinkage team to have answers to the following questions:

- Which products are to be the focus of the project (this needs to be highly focussed and not based upon generalised categories of goods)?

- What are the goals of the stock loss reduction activity (such as clearly defined and measurable impacts upon shrinkage, sales and or out of stocks)?

- How far along the supply chain will the investigations take place (such as from point of manufacture to the retail distribution centre or from the point of delivery to the store and eventual sale to a customer)?

- Who needs to be involved in the project and how will they react to it (this will vary depending upon the range of the supply chain being considered)?

- When is the date by which some benefits must be identifiable (the project may have to take account of seasonality and expectations within the business)?

- What are the constraints to undertaking the Shrinkage Road Map (such as seasonality, possible ambivalence or hostility from particular parts of the organisation about the work of the group)?

The answers to these questions guide the project team’s activities towards achieving their goals. Starting the project in this way is especially important in cross-functional/inter-company projects where the effectiveness and efficiency with which project resources are used dramatically improves with up-front investment in planning.

Step 2: Map Key Processes and Measure Problem

The second step focuses upon a rigorous diagnosis of the problem based upon the range of the supply chain selected and the products under consideration. It also needs to consider all the operational processes and procedures which play a part in the products’ life cycle. This step is a crucial part of the Shrinkage Road Map. It seeks to develop a very detailed map of a given product’s physical movement through a retail supply chain and the information flow associated with it. The aim is to identify how at each point the product and its associated information interacts with various people, processes or procedures, and whether potential packaging-related failures associated with this flow create the opportunity for shrinkage. The most effective way to do this is through the use of Process Mapping.

Process Mapping

Documenting the movement of particular products through a supply chain helps individual people view their work from a process perspective. Often, existing ways of working have never been described or even viewed as processes – they can often simply be viewed as ‘the way we do things’. Process mapping is a technique used to detail business processes that focuses on the important elements that influence behaviour, allowing the business to be viewed at a glance.

Process mapping can be carried out at a number of different levels, with some focusing more at the macro level, such as the movement of products between different locations, such as from a manufacturers site to a distribution centre and then on to a store; the meso level, such as the movement of goods within a particular location, such as from the back of a store to the front of the store; and at the micro level, such as the precise movements and processes associated with a product as it moves within a given part of a location, such as a receiving area within a store.

The data for creating a process map is best collated by physically following products as they pass along the supply chain. This involves visiting each site that the product passes through and documenting the steps involved in its journey such as receiving, storage, dispatch and so on. It is important to stress the importance of physically following the product – there can be an enormous difference between what is supposed to happen and what actually does take place as the product moves along the supply chain. Generally speaking, the more detailed a process map can be, the more useful it becomes and is an important component when analysing the overall threats a given product and its packaging faces as it moves through a supply chain.

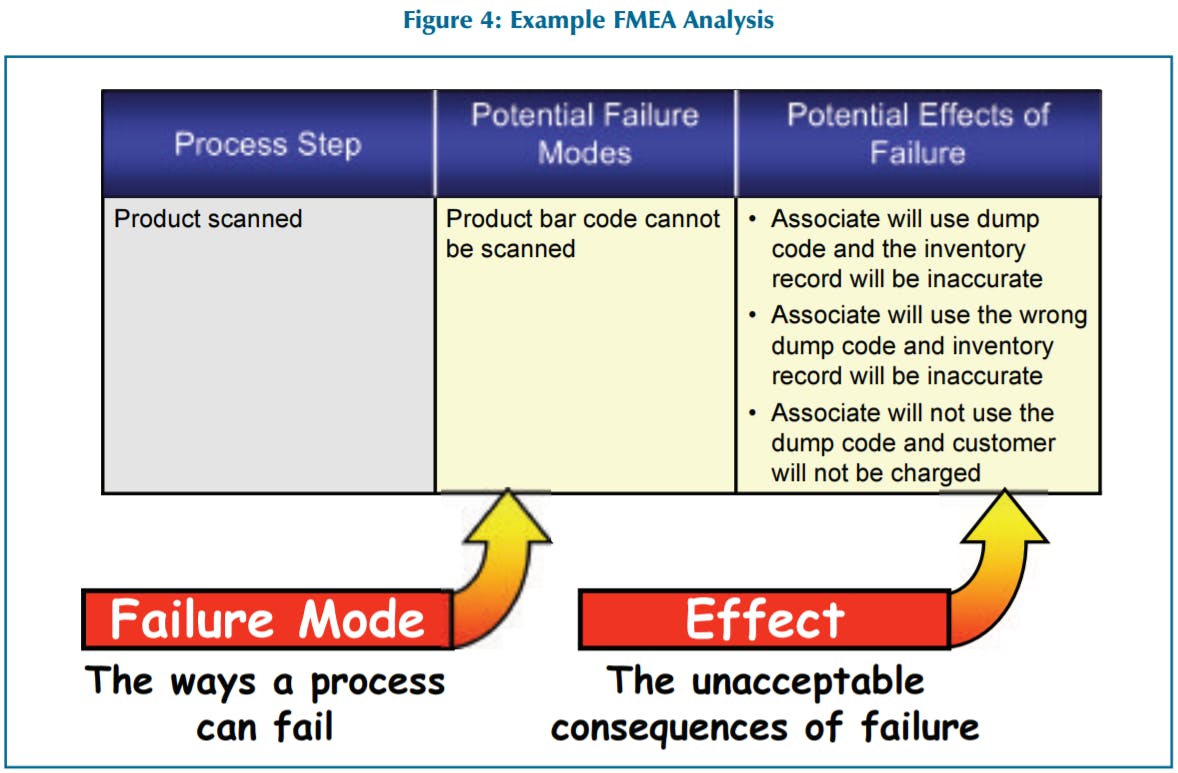

Step 3: Analyse Risk, Identify Causes and Prioritise Actions

Once the process map is complete and all available data has been collected, the next stage is to analyse the process itself together with the data collected to determine and prioritise the many possible packaging-related failures that could create the opportunity for shrink. With these ‘drivers’ of shrinkage prioritised, the possible root causes of these failures can then begin to be understood.

A useful tool for undertaking this is Failure Mode and Effects Analysis (FMEA). This tool is particularly good at identifying the various ways that processes and procedures may fail, as well as determining the effect of different failure modes. In particular, FMEA enables you to score the potential risk of different failure modes based upon the severity of the loss should a failure happen, the likelihood of a failure occurring and the ability to detect that a failure has occurred. Once these scores are made they can then be multiplied together to provide an overall risk score for each of the potential failure modes. This enables the most vulnerable packaging-related failures to be identified and then these become the focus of the next stage of the Shrinkage Road Map – the selection of potential solutions.

Cause and Effect Analysis

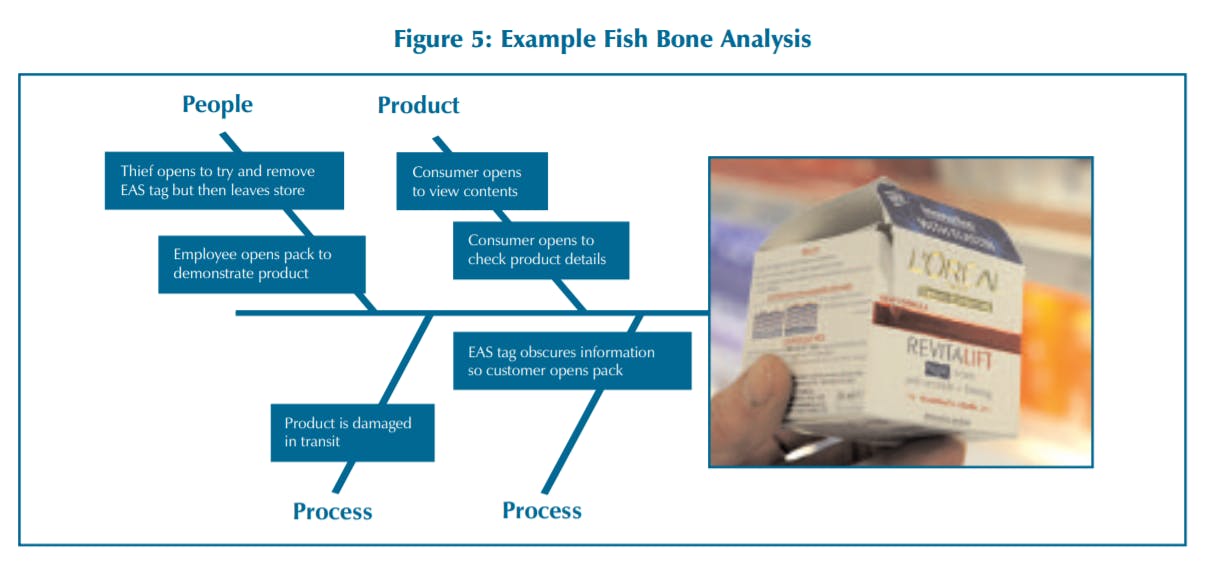

This technique is especially useful when employed to structure the outcome of a brainstorming session with a project team, when they contribute their findings, experience and understanding. The main spines of the diagram are given broad headings (these are fairly arbitrary and can be selected by the project team) around which causes to the symptom of a problem are grouped. To focus effort, the major causes of problems need to be identified from amongst the trivial many. Where possible, this should be achieved statistically through the collection of data highlighted in the previous stage of the Shrinkage Road Map. If all the data is not available, then it is possible to get the project group members to identify many of the most significant problems from their experience. Outlined below is an example where the packaging on a product has become damaged and some possible explanations have been identified grouped around people, processes, procedures and product issues.

Five Whys

Once initial ideas have identified the main causes of the packaging-related problem for a given product, another technique – the Five Whys – can be used to explore the deeper underlying root causes. This technique explores the underlying causes of losses as fully as possible by repeating the question, ‘why?’ five times as this has been found to be the number of times it takes before the root cause of the problem is identified. For example:

Initial problem: Product is incorrectly scanned at the checkout:

Why? Till operator made a mistake.

Why? Scanned the wrong barcode.

Why? More than one barcode visible and readable.

Why? Barcode visible on promotional packaging and individual products.

Why? Poor collaboration between retailer and manufacturer on product packaging brief.

Through the use of this deceptively simple technique, the root causes of problems can be quickly identified.

Through the use of FMEA and a number of other tools and techniques, it is possible to identify the key failure modes associated with any given process and identify what the underlying root causes may be. This approach, however, is critically dependent upon the previous step – developing a comprehensive process map of the products movement and information flow through the supply chain – without it the various modes of failure will not be identified. It is also dependent upon the quality and diversity of the people brought together in the project team. By having representatives from different parts of a retail business and indeed those from outside the organisation, fresh insights and alternative interpretations of likely causes can be developed. This third step in the Shrinkage Road Map is as much about identifying root causes and brainstorming ideas as it is about collating information and drawing conclusions. Once this step has been completed, then the project team can move on to the next part of the Shrinkage Road Map, which is concerned with developing solutions and prioritising actions.

Step 4: Develop Solutions and Prioritise Actions

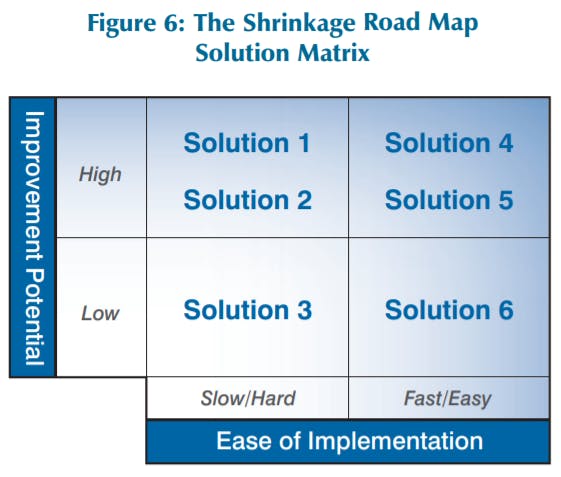

The majority of solutions are usually extremely context-specific and it is not the purpose of this report to detail all those that are available to the loss prevention practitioner. However, for many problems there could well be a number of potential solutions and therefore, the Shrinkage Road Map approach suggests using a Solution Matrix to determine the applicability of any given range of potential solution (see Figure 6).

Most solutions can be gauged against two key variables: the ease with which it can be implemented in a given retail environment, ranging from very slow and hard to accomplish through to being very fast and easy to implement; and the improvement potential it can deliver, ranging from low through to high (this could be expressed in monetary terms or perhaps in a percentage reduction in shrinkage) The improvement potential also takes into account the anticipated cost of the solution. Given these two variables, potential solutions can then be placed upon the matrix based upon how they score.

Step 5: Implement Solutions

In a similar manner to the approach used to plan the original Shrinkage Road Map, the implementation of any proposed solution requires project planning. Critical to successful implementation is the identification of a primary sponsor who will be responsible for delivering the benefits of the project. To achieve success the sponsor, usually a senior manager, needs to ensure that the project team constructs a clear and robust business case. This business case defines what is to be delivered, the benefits this will bring and the resources required.

The creation of an implementation plan is necessary to map the best use of resources to achieve the desired objectives within time and cost limitations. Here the tools of project management will prove useful, whether applied to small or largescale projects. Where a project team undertakes planned change for the first time, the plan should consider not just the task but also the learning necessary to deliver it. At a top level, a project plan is constructed by following a sequence of steps, as described below:

- Identify the overview tasks needed to complete the project.

- Show the interrelationships between tasks and the sequence in which they can be undertaken.

- Estimate the types and amount of effort needed to complete these tasks.

- Calculate the resource profile over time to complete the project.

- Identify potential risks to successful project delivery.

- Mitigate risks or plan contingency.

- Iterate the plan to match it against resource availability.

- Secure resource.

- Put in place procedures for evaluation.

Evaluating the effectiveness of the stock loss reduction effort provides information that guides the direction of the next cycle of loss reduction – evaluating the implementation.

Step 6: Evaluate Implementation

The stock loss reduction project ideally ends with an effective solution in place. However, this is not the end of stock loss reduction as a whole. From the organisation’s perspective, evaluation of one project is important in order to determine the success of the solution and guide future projects. The review is therefore the last step of one project and perhaps the first step of the next. The evaluation should be rigorous, robust and led by somebody who can provide an objective review, independent of equipment providers and those who may have commissioned the project in the first instance. They need a clear mandate to assess the performance of the implemented solution and compare this against the level of performance originally planned.

In addition, the aim of this feedback phase is to identify whether any further action is required before the current project can be signed off and to gain a better appreciation of successful approaches and solutions that might be applied during future projects. It should be noted, however, that the evaluation process may need to be ongoing as the performance of an initiative can change as its ‘environment’ alters.

Minimising Packaging Related Shrinkage

This report has outlined the scale and nature of the shrinkage problem faced by retailers and their suppliers. It has also focussed upon the role that packaging can play in generating shrinkage, looking particularly at the way in which damage, waste, error and theft can result from packaging decisions. It has also put forward a methodology which the retail sector can use to begin to identity the various ways in which packaging may be the defining factor in why some forms of shrinkage is happening. It is a tried and tested approach that focuses upon the identification of the root causes of common shrinkage problems as they impact upon particular vulnerable products.

This next section proposes a number of key areas where better consideration of packaging could have a dramatic and profound impact upon the shrinkage losses suffered by the retail sector.

As we outlined in the last section, because particular solutions are very content specific, varying by the type of product under consideration and the peculiarities of the retailing environment within which it moves, these guidelines can only address the more generalised issues relating to shrinkage and product packaging. It is also worth noting that if changes are to be proposed to packaging to try and reduce problems that may generate shrinkage, early engagement, particularly for new products is critical – lead in times can be as long as 36 months for the launch of new products.

Importance of Understanding the Retail Landscape

The journey from point of manufacture to point of sale and beyond can for some products be arduous and risk prone. There are a plethora of opportunities for products to get damaged, lost, inadvertently misplaced, stolen and indeed for some items to go out of date. Moreover, the modern retail environment is highly complex. It increasingly requires just in time stock management, the rapid movement of large quantities of goods, and employs staff who are under increasing pressure to do more in less time. It has also to deal with increasingly fickle and demanding customers who expect greater choice, competitive pricing and products that look exactly like they are portrayed in the advertising. All of these factors and more combine to put considerable pressure on the way in which goods are packaged.

When considering how to design packaging that will be less likely to generate shrinkage, it is vitally important to understand the retail landscape that given products will move through as they make their way to the customer. This is where the ECR Europe Shrinkage Road Map offers real value. It provides the industry with a methodology to carefully analyse how particular products interact with the retail landscape and at what points product packaging becomes vulnerable, particularly to damage.

As we detailed earlier, this risk will vary as a product moves along the supply chain and the packaging needs to be able to adjust to the environment within which it is operating. For instance, the demands on outer packaging are considerable as the product moves through the early stages of the supply chain where the pressures of moving high volumes of stock inevitably leads to a more robust approach to handling and storage. As the product nears the retail store, the demands of the packaging begin to change, moving away from a priority on withstanding robust handling towards being more about enabling quick and accurate identification of products and the ability to apply product protection (where applicable). Mapping out this changing demand (and associated risks) is an important part of developing product packaging that is less likely to generate shrinkage.

Balancing Efficiency and Protection

Clearly minimising shrinkage is not the only criteria considered when packaging is designed – other factors a much more likely to dominate the agenda such as cost, ease of handling, convenience, aesthetics and productivity. What this research has identified is that some of the decisions made to improve these factors can have a consequential impact upon the likelihood of packaging to generate shrinkage.

For example, products that have perforated edges to enable customers to open them more easily, or where packaging has been designed to facilitate quick and easy restocking of retail shelves (such as shelf-ready packaging) may be more prone to damage earlier in the supply chain due to the robust handling practices these products are likely to encounter. Similarly, the use of plain and unbranded outer packaging may reduce printing costs but can lead to products being overly difficult to identify, which can lead to mis-picks and packaging being unnecessarily opened leading to damage and potential theft.

There is undoubtedly a balance to be struck between ensuring that packaging maximises efficiency and delivers value in the retail environment and at the same time ensures that the risk of shrinkage in minimised. This requires two things. First the use of the ECR Shrinkage Road Map to identify the relationship between any given packaging design and likely incidents of shrinkage, including careful consideration of the financial impact of the latter and the likely cost of implementing a solution on the former.

Secondly, there is a need for a greater role for loss prevention specialists in the early stages of packaging design, particularly for new products. By doing this, it is much more likely that a better balance will be struck between the requirements for supply chain efficiency and ensuring that the risk of shrinkage is minimised. Through dialogue, a better balance can be achieved which recognises the needs of all parties concerned.

Sustainability and Risk

As detailed at the beginning of this report there are ongoing tensions between the need to meet the growing demand for sustainability and associated savings in packaging and the need to minimise the risk of shrinkage. Good packaging is vital if products are to survive their supply chain journey and be capable of being effectively protected from theft when they are displayed on the retail shelf. While there appears to be growing consumer and Government pressure to minimise the use of packaging, from a shrinkage perspective the reverse can sometimes be the case.

Criminological research has shown that the ability to easily conceal small high value products is a key part of a thief’s decision-making process. The evidence seems to suggest that increasing the size of packaging makes a product less easy to be concealed and then stolen. But there are also concerns about the use of particular types of packaging such as plastic clamshells that are viewed as environmentally unfriendly.

Once again, research would suggest that these have proven relatively effective in making it more difficult for would-be thieves to remove products from packaging in the store and also make it easier to apply protection devices such as EAS hard tags. This perhaps points towards a need to more effectively communicate the rationale for packaging decisions rather than changing the packaging itself.

Help Correctly Identify Products in the Supply Chain

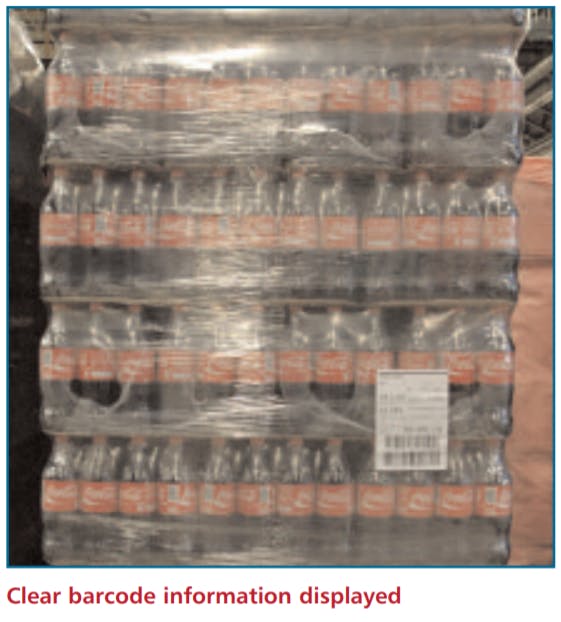

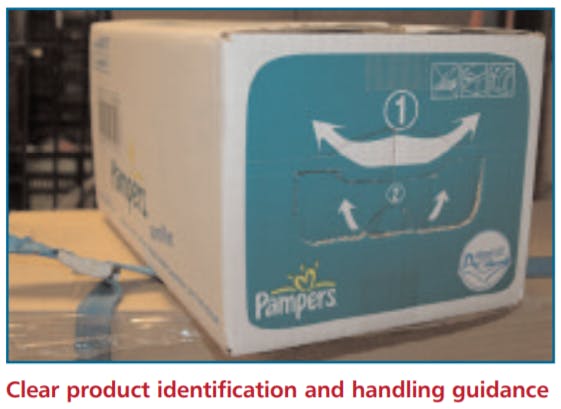

As detailed earlier, shrinkage can be caused by the difficulties of identifying products in the supply chain. This can manifest itself in various ways and clearly points to the need for careful analysis of the way in which packaging is designed to minimise this problem. Clearer labelling to make identification of products easy is important at various stages in the supply chain including when the products are being selected at the picking stage in retail warehouses and when staff are selecting products in the back of stores to restock shelves.

Similarly, the use of bar codes can cause confusion both within the supply chain and at the point of purchase, with more than one barcode on multi packs being a good example of this. Differentiating between products within a range can be particularly challenging for time-pressed retail staff and some good work has already been done on using colour coding to help staff identify differences. This problem can also impact upon the quality of stock auditing and any errors arising from this can adversely impact upon store inventories leading to out of stocks, as well as theft, damage and spoilage.

Help Enable Product Protection

The use of EAS tagging and other security devices on products perceived to be at risk from theft has a long track record in retailing and their use is likely to increase further in the future. This is because other forms of security such as present and watchful employees are becoming a more expensive and inevitably rarer resource and the large supermarket chains are stocking greater ranges of non-food products that were traditionally sold in bespoke outlets where higher levels of staff vigilance was possible.

How the majority of these security products have been applied can best be described as ad hoc, inconsistent and on many occasions to the detriment of the carefully designed aesthetics of the product packaging. Early we provided a number of pictorial examples of how both soft and hard EAS and security stickers have been applied to products in ways that obscure key product information and make them more difficult to display on retail shelves in ways that look appealing and maximise shelf use. Similarly we identified examples of where the application of security devices, in particular hard tags has been highly compromised because of the nature of the packaging to which it is being applied. We also showed how the application of devices such as spider tags could damage the product packaging.

What is required is a much more holistic and considered approach to how products are likely to be protected in the retail environment and the implications upon the design of packaging. For instance, if soft tags are to be applied (either at source or in the retail store or distribution centre) then it would seem sensible for space to be made available (preferably close to the barcode to assist in deactivation) for the tag to be attached where it does not obscure product information.

Tags that are placed inside the packaging should also, where necessary, be located near the barcode as well. Similarly, if hard tags are to be used, then how they will be attached and secured to packaging should also be considered. For instance, should there be a pre-drilled hole for the tag to be applied through, should the area around where the tag will be attached be made of a material that is more durable and less prone to ripping?

These are merely examples, but the key is that by using the ECR Europe Shrinkage Road Map, these sorts of issues can be indentified and critically, through collaboration across the supply chain, more thoughtful and robust solutions developed.

Shrink Prevention Packaging Guidelines

While the comments above offer a broad overview of the key areas for consideration when undertaking a review of shrinkage that may be caused by packaging, detailed below are a collection of guidelines that have emerged from this research. They are in no way exhaustive but should be considered more as ideas to consider when undertaking the ECR Europe Road Map to identity the risks generated by packaging and how in turn they may be best minimised.

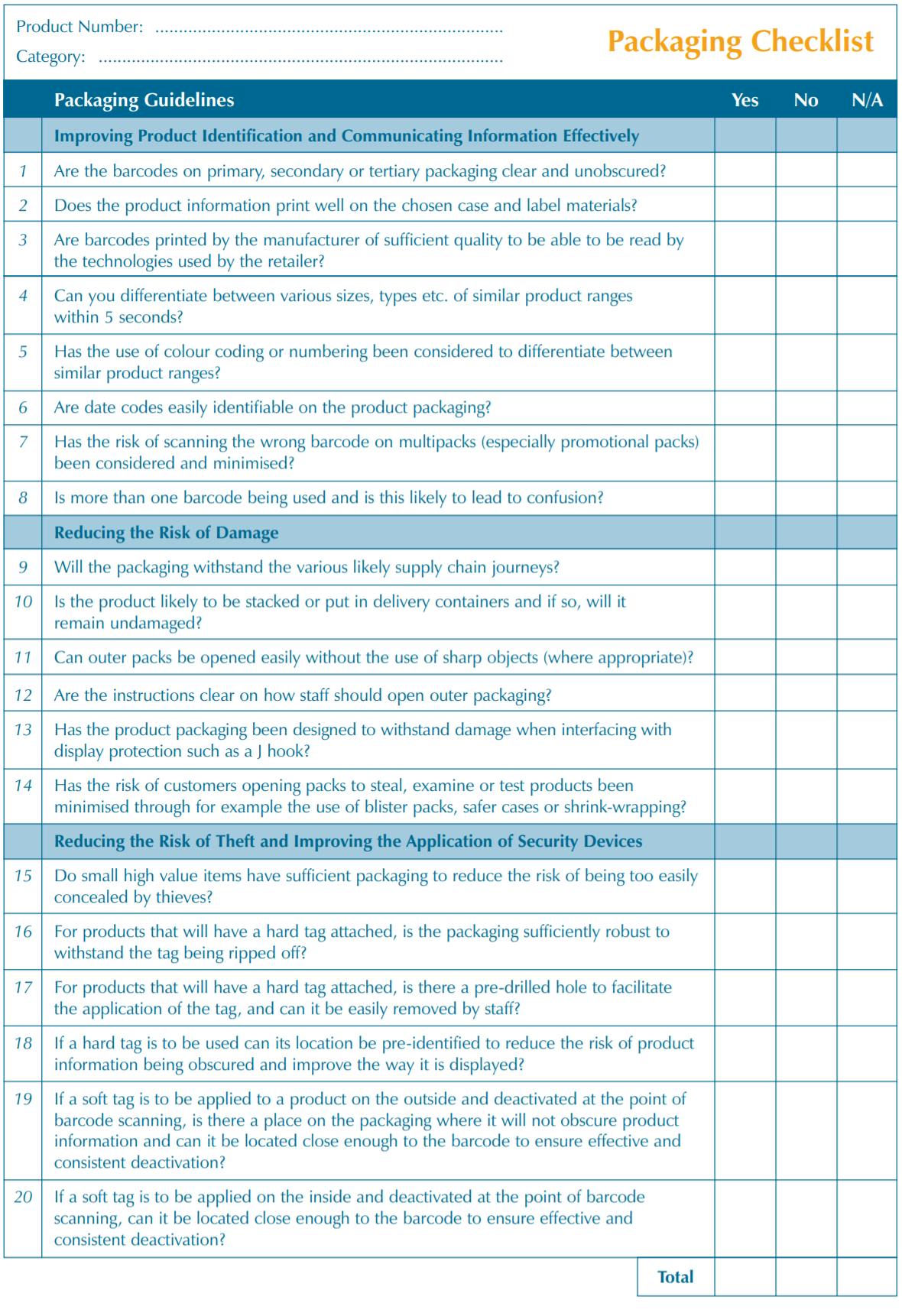

They have been grouped into three key areas: improving product identification; reducing the risk of damage; and minimising the risk of theft and improving the application of product security devices. This is then followed by a simple 20-point checklist that can be used to review the risk of packaging-related shrink for any give product and should be used in combination with the ECR Shrinkage Road Map detailed earlier.

Improving Product Identification

- Select printing/coding technology that is a good match for customer data reading processes.

- Select outer case liner or data label materials that are compatible with the requirements of the printing process.

- To prevent misidentification of palletised loads the barcode on the tertiary or secondary packaging should not be concealed or obscured.

- Secondary retail-ready packaging must be clearly identifiable both from other products and from other variants in the same range. This is essential for merchandisers to identify the product in the back of store where it may be on a roll cage of mixed goods.

- As a useful control check always print the pallet loading pattern on outers, this helps both to reduce the chance of the wrong loading pattern being used and to make this more obvious if it occurs.

- Consider utilising a combination of colour coding, wording and numbering that reduces ambiguity to a minimum.